nebraska sales tax calculator vehicle

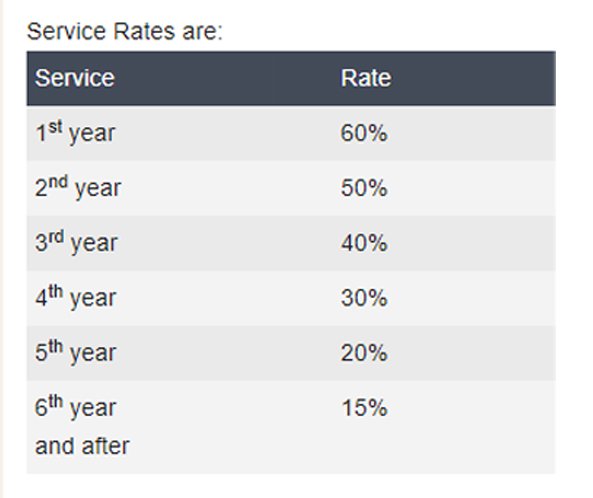

See our manual car tax calculator and use the override option to fine tune your auto loan quote. The percentage of the Base Tax applied is reduced as the vehicle ages.

Nebraska Income Tax Ne State Tax Calculator Community Tax

Multiply the sales tax fee with the vehicle price before trade-in or incentive.

. You should figure out your citys sales tax on the car to calculate sales tax. Find your state below to determine the total cost of your new car including the car tax. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

There are no changes to local sales and use tax rates that are effective July 1 2022. Calculating Sales Tax Summary. The Nebraska state sales and use tax rate is 55 055.

The Online Vehicle Tax Estimator has been used frequently by Nebraskans since being released. At least 7 points is required. Assuming you spend 20000 on a vehicle the state sales tax is 7 percent.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Next year there will be no sales tax due while the motor vehicle tax will decline to 630.

Cost Breakdown In our calculation the taxable amount is which equals the sale price of plus the doc fee of plus the extended warranty cost of plus the GAP charge of minus the trade-in value of minus the rebate of. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

Registration Year Base Tax Amount 1 2 3 4 5 6 7 8 9 10 11 12 13 14 95 year 1 see below 0 to 3999 2500 25 2250 2000 1750 1500 1275 1050 825 600 375 175 000 2375. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022. If the same truck was registered outside the city limits in York County which has no wheel tax and no local sales tax the bill would look like this.

For vehicles that are being rented or leased see see taxation of leases and rentals. According to the 2007 NASCIO submission the application performed an average of 3200 estimates a. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed.

The MSRP on a vehicle is set by the manufacturer and can never be changed. ArcGIS Web Application - Nebraska. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. Because this trucks MSRP is about 40000 the first year of motor vehicle tax is 700. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Nebraska Income Tax Ne State Tax Calculator Community Tax

Vehicle And Boat Registration Renewal Nebraska Dmv

Nebraska Income Tax Ne State Tax Calculator Community Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

What S The Car Sales Tax In Each State Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Nebraska Income Tax Ne State Tax Calculator Community Tax

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Tax On Cars And Vehicles In Nebraska

Tennessee Sales Tax Calculator Reverse Sales Dremployee